Efficiencyin digital issuance is primarily a function of supportcosts, and a major determinant of support costs isthe costs of fraud and theft. This system creates bullet proof accounting systems for aggressive uses and users. It not only lowers costs by delivering reliable and supported accounting, it makes much stronger governance possible in a way that positively impacts on the future needs of corporate and public accounting. For instance, a blockchain could triple journal entry be created once a contract is signed, then a purchase order could be issued against that contract, bills against that purchase order, payments against those bills, etc., tracking any issues that arise along the way. There would be a unique ID related to the contract/purchase order/bills in that chain to tie all of those separate pieces together. A blockchain wallet is a digital wallet that allows you to store, send, and receive cryptocurrencies like Bitcoin.

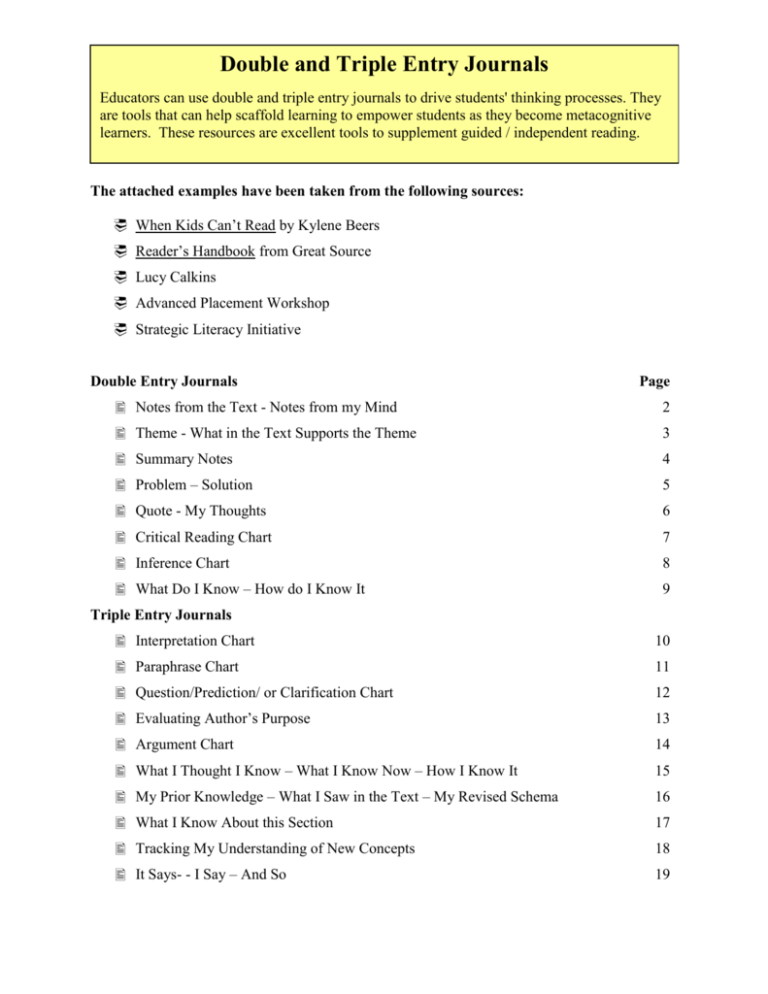

Implementing Triple Entry Accounting as an Audit Tool—An Extension to Modern Accounting Systems

When new transactions are made, chains fork into longer sequences to form a blockchain. In the context of blockchain, a ledger is simply a digital record of all transactions that have taken place on the blockchain. This could be seen as analogous to a traditional bank ledger, which records all financial transactions that take place within the bank. We have operated this system on a small scale.Rather than be inefficient on such a smallscale, the system has generated dramaticsavings in coordination. No longer are billsand salaries paid using conventional monies;many transactions are dealt with by internalmoney transfers and at the edges of thecorporation, formal and informal agents workto exchange between internal money andexternal money.

Support

For example, money received from a business loan will increase its cash account and increase its loans payable account . The cash balance declines as a result of paying the commission, which also eliminates the liability. The reason your debit card is called a debit card is because the bank shows your balance as a liability because they owe your money to you—in essence, they are just holding it for you. It can take some time to wrap your head around debits, credits, and how each kind of business transaction affects each account and financial statement. While triple-entry accounting isn’t the term for it, there are considerable benefits in writing transactions to a blockchain.

Types Of Pro Forma Financial Statements

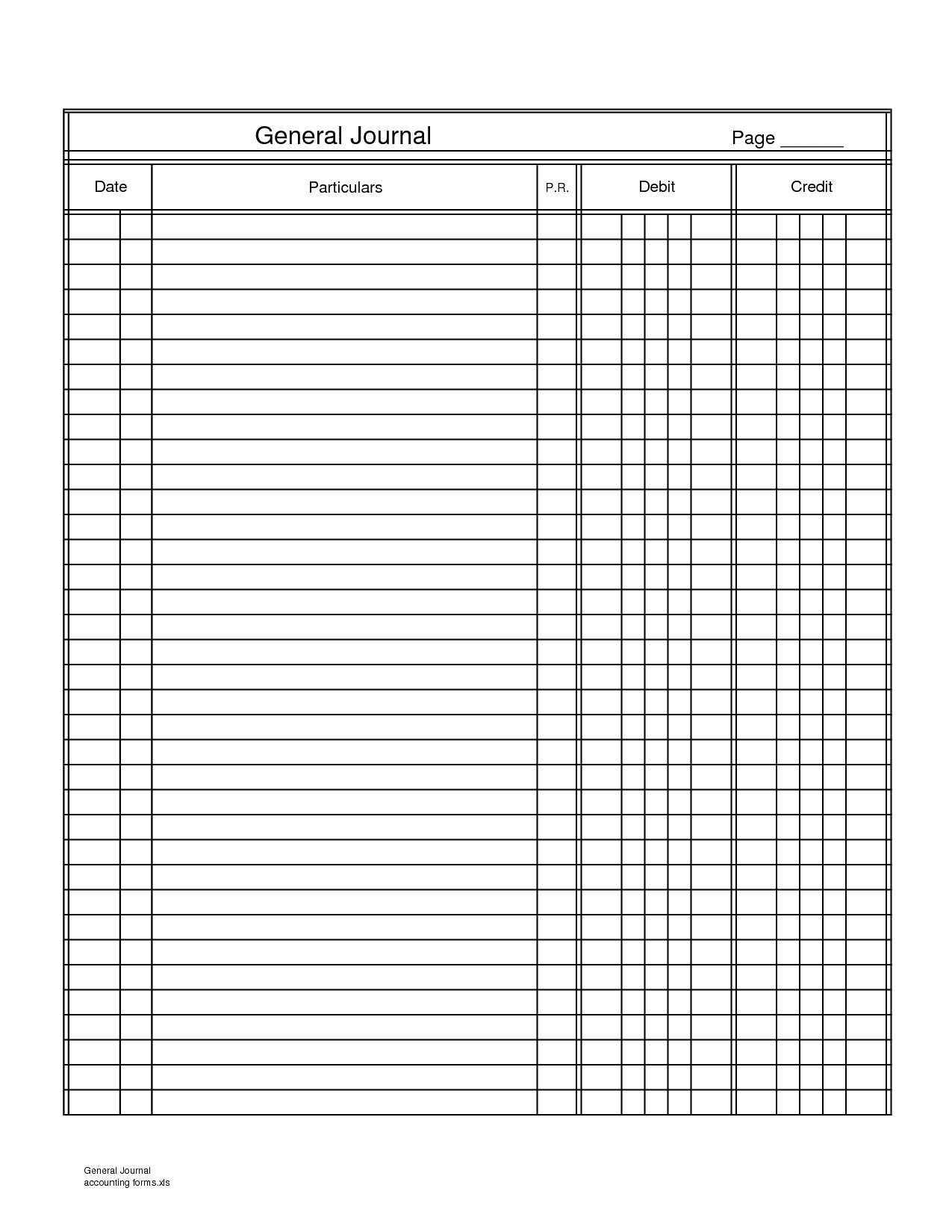

Double-entry bookkeeping means that a debit entry in one account must be equal to a credit entry in another account to keep the equation balanced. Just as liabilities and stockholders’ equity are on the right side of the accounting equation, the liability and equity accounts in the general ledger have their balances on the right side. To increase the balance in a liability or stockholders’ equity account, you put more on the right side of the account.

Triple/three column cash book

The discount column is only totaled; it is not balanced because it does not work as an account. Now, as the payment links back,and the invoice is a live transaction within the threeentries in the three accounting systems, it is possiblefor a new updated invoice record to refer back to thepayment activity.When the payment clears, the new record canagain replace the older unpaid copy andpromulgate to all three parties. In order to calculate balances on a relatedset of receipts, or to present a transactionhistory, a book would be constructedon the fly from the set.This amounts to using the Signed Receiptas a basis for single entry bookkeeping.In effect, the bookkeeping is derived fromthe raw receipts, and this raises thequestion as to whether to keep the booksin place. This property is enabled by means of three features,being the separation of all books into two groupsor sides, called assets and liabilities,the redundancy of the duplicativedouble entries with each entryhaving a match on the other side,and the balance sheet equation, which says thatthe sum of all entries on the asset sidemust equal the sum of all entries on theliabilities side. Having a ledger that easily shows the entire string of related transactions would not only provide excellent audit records, it would allow both parties to a transaction to have real-time status updates. Every time the blockchain is updated with a new record, both parties to the transaction are able to immediately see the update.

Double Entry

The triple-column cash book (also referred to as the three-column cash book) is the most exhaustive form of cash book, which has three money columns on both receipt (Dr) and payment (Cr) sides to record transactions involving cash, bank, and discounts. A triple-column cash book is usually maintained by large firms that make and receive payments in cash as well as by bank and which frequently receive and allow cash discounts. Double Entry bookkeeping provides evidence ofintent and origin, leading to strategies fordealing with errors of accident and fraud.The financial cryptography invention of thesigned receipt provides the same benefits,and thus challenges the 800 year reign ofdouble entry.Indeed, in evidentiary terms, the signed receiptis more powerful than double entry records due tothe technical qualities of its signature. Recent advances in financial cryptography have provideda challenge to the concept of double entry bookkeeping.The digital signature is capable of creating a recordwith some strong degree of reliabilty, at least in thesenses expressed by ACID, above.A digital signature can be reliedupon to keep a record safe, asit will fail to verify if anydetails in the record are changed. Another major digital money system lasted for manyyears on a single entry accounting system.

- Currently, the primary use of this technology is for bitcoin and other cryptocurrencies but blockchain will entirely disrupt accounting processes as we know them — it’s only a matter of time.

- First, ensurethat all entries are complete, in that they refer totheir counterpart.

- Since the entries are distributed and cryptographically sealed, falsifying them or destroying them to conceal activity is practically impossible.

- So what we now see is that massive amount of administration could be removed if we had an economy-wide accounting system.

- In the context of blockchain, a ledger is simply a digital record of all transactions that have taken place on the blockchain.

- Every participant on a blockchain has a secure copy of all records and changes, so every user can see the provenance of the data by sharing all records.

From here, you can adjust and add different accounts to portray your business transactions more accurately. As you can see, the entire accounting process starts with double-entry bookkeeping. There are several different types of accounts that are used widely in accounting – the most common ones being asset, liability, capital, expense, and income accounts. Double-entry bookkeeping ensures that for every entry into an account, there needs to be a corresponding and opposite entry into a different account.

The total of the discount column on the credit side represents the total cash discount received from suppliers during the period and is posted to the discount received account maintained in the ledger. The innovations present in internal moneygo beyond the present paper, but sufficeto say that they answer the obvious questionof why this design of triple entry accountingsprung from the world of digital cash, andhas relevence back to the corporate world. The precise layout of the entries in softwareand data terms is not settled,and may ultimately become one ofthose ephemeral implementation issues.The signed receipts may form a naturalasset-side contra account, or theymay be a separate non-book list underlyingthe bookkeeping system and its two sides. Because information is collected directly from the double-entry bookkeeping transactions, accounting information in companies that use double-entry bookkeeping is simple to prepare. Businesses must produce accurate financial statements in a timely and efficient manner. Blockchain technology provides us with many benefits, and triple entry bookkeeping is one of those which can be used across many useful ways as it is fundamental to revolutionizing the way we manage finances.

In some strict sense of relational database theory,double entry book keeping is now redundant;it is normalised away by the fourth normal form.Yet this ismore a statement of theory than practice, andin the software systems that we have built, thetwo remain together, working mostly hand in hand. The first section presents a brief backgrounderto explain the importance of double entrybookkeeping. It is aimed at the technologist,and accountancy professionals may skip this.The second section presents how the SignedReceipt arises and why it challenges doubleentry bookkeeping. A business must keep as close an eye on its income as it does on its expenses, which is why every business needs to use double-entry bookkeeping. By having all this information to hand, companies are also better able to forecast future spending. In layman finance terms, a blockchain is a digital ledger of all cryptocurrency transactions.

Keep in mind that every account, whether an asset, liability or equity, will have both debit and credit entries. In order to achieve the balance mentioned previously, accountants use the concept of debits and credits to record transactions for each account on the company’s balance sheet. And, with a single-entry system alone, large firms cannot accurately track their assets, liabilities, equities, revenues, and expenses. When you get started with accounting software, you can connect your various business accounts, and transactions will import automatically.