For instance, utility companies often exhibit high D/E ratios due to their capital-intensive nature and steady income streams. These companies frequently borrow extensively, given their stable returns, making high leverage ratios a common and efficient use of capital in this slow-growth sector. Similarly, companies in the consumer staples industry tend to show higher D/E ratios for comparable reasons. Understanding these distinctions is crucial for accurately interpreting a company’s financial obligations and overall leverage. Determining whether a debt-to-equity ratio is high or low can be tricky, as it heavily depends on the industry. In some industries that are capital-intensive, such as oil and gas, a “normal” D/E ratio can be as high as 2.0, whereas other sectors would consider 0.7 as an extremely high leverage ratio.

Exact Formula in the ReadyRatios Analysis Software

Understanding this ratio is crucial for both internal and external stakeholders, including investors, creditors, and analysts, who use it to assess the company’s leverage position and risk level. It’s important to analyse the company’s financial statements, cash flows and other ratios to understand the company’s financial situation. The debt-to-equity ratio is the most important financial ratio and is used as a standard for judging a company’s financial strength. When examining the health of a company, it is critical to pay attention to the debt-to-equity ratio. If the ratio is rising, the company is being financed by creditors rather than from its own financial sources, which can be a dangerous trend.

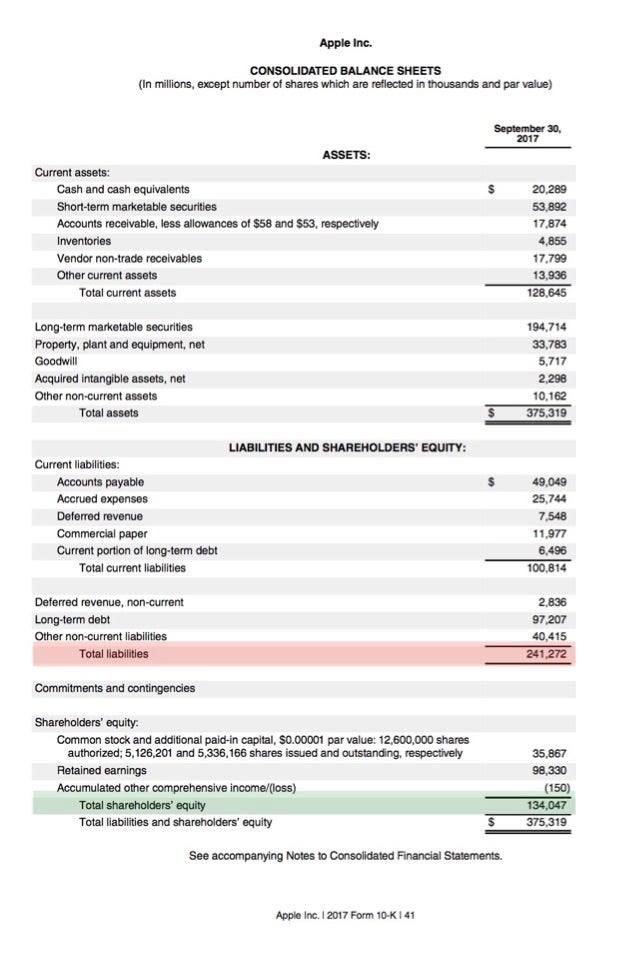

Total Liabilities

The debt-to-equity ratio is one of several metrics that investors can use to evaluate individual stocks. At its simplest, the debt-to-equity ratio is a quick way to assess a company’s total liabilities vs. total shareholder equity, to gauge the company’s reliance on debt. There are several metrics that are used to gauge the financial health of a company, how the company finances its business operations and assets, as well as its level of exposure to risk. The D/E ratio is a financial metric that measures the proportion of a company’s debt relative to its shareholder equity.

Example 4: Company D

A negative D/E ratio indicates that a company has more liabilities than its assets. This usually happens when a company is losing money and is not generating enough cash flow to cover its debts. This tells us that Company A appears to be in better short-term financial health than Company B since its quick assets can meet its current debt obligations. Although debt financing is generally a cheaper way to finance a company’s operations, there comes a tipping point where equity financing becomes a cheaper and more attractive option. A higher D/E ratio means that the company has been aggressive in its growth and is using more debt financing than equity financing. A company’s accounting policies can change the calculation of its debt-to-equity.

Yes, lease liabilities are generally included in the debt-to-equity ratio. Therefore, lease liabilities are recorded on a company’s balance sheet and classified as current or non-current liabilities. A debt-to-equity ratio of 1 means a company has a perfect balance between its debt and equity, and that creditors and investors own equal parts of the company’s assets. To calculate your company’s debt-to-equity ratio you’ll need your company’s total liabilities and shareholders’ equity. Your company’s equity is the total value of its assets, after deducting liabilities. Companies can manage their Debt to Equity ratio by controlling debt levels and increasing equity through retained earnings or issuing new shares.

A high debt to equity ratio means that a company is highly dependent on debt to finance its growth. It is important to note that while these advantages make the D/E ratio a useful tool, it should not be used in isolation. It should be part of a broader analysis that includes other financial ratios and metrics.

Strategic management of this ratio is crucial for long-term financial health. A D/E ratio of 1.5 would indicate that the company has 1.5 times more debt than equity, signaling a moderate level of financial leverage. Assume a company has $100,000 of bank lines of credit and a $500,000 mortgage on its property.

Companies with a high D/E ratio can generate more earnings and grow faster than they would without this additional source of funds. However, if the cost of debt interest on financing turns out to be higher than the returns, the situation can become unstable and lead, in extreme cases, to bankruptcy. We have the debt to asset ratio calculator (especially useful for companies) and the debt to income ratio calculator (used for personal financial purposes). The D/E ratio indicates how reliant a company is on debt to finance its operations. When interpreting the D/E ratio, you always need to put it in context by examining the ratios of competitors and assessing a company’s cash flow trends.

- In fact, debt can enable the company to grow and generate additional income.

- The 10-K filing for Ethan Allen, in thousands, lists total liabilities as $312,572 and total shareholders’ equity as $407,323, which results in a D/E ratio of 0.76.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- A steadily rising D/E ratio may make it harder for a company to obtain financing in the future.

- When evaluating a company’s debt-to-equity (D/E) ratio, it’s crucial to take into account the industry in which the company operates.

The Debt to Equity ratio is a financial metric that compares a company’s total debt to its shareholder equity. This looks at the total liabilities of a company in comparison to its total assets. On the surface, this may sound like the debt ratio formula is the same as the capital expenditures and other cash needs for a business debt-to-equity ratio formula. However, the total debt ratio formula includes short-term assets and liabilities as part of the equation, which the debt-to-equity ratio discounts. Also, this ratio looks specifically at how much of a company’s assets are financed with debt.

A low debt to equity ratio, on the other hand, means that the company is highly dependent on shareholder investment to finance its growth. Again, remember that what is considered a ‘good’ or ‘bad’ D/E ratio can vary depending on the industry and economic conditions. Therefore, it’s essential to use this ratio in conjunction with other financial metrics and analyses to make informed investment decisions. Now We will calculate the Debt Equity Ratio using the debt to equity ratio formula. A debt-to-equity ratio of 0.5 means a company relies twice as much on equity to drive growth than it does on debt, and that investors, therefore, own two-thirds of the company’s assets.